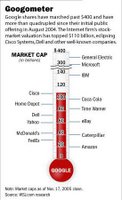

There has been lots of talk about Google recently (NASDAQ: GOOG). My brother commented the company is the “darling of the moment on Wall Street”. Is that a fair characterization or is Google for real? Perhaps the more important question is whether the stock is overvalued or undervalued?

This weekend I came across commentary in the Wall Street Journal’s Breakingviews about the merits of breaking up Microsoft (NASDAQ: MSFT). I don’t agree with that proposition but that’s a topic of discussion for another time. The article also talked about Google and compared its valuation to that of Microsoft’s at the same point in the companies’ lifecycles. Indeed, Google’s shares are pricier than Microsoft’s were in their early days. The conclusion was that an investor buying into Google shares would not see the same upside as an investor that had bought into Microsoft shortly after its IPO.

It is hard to argue against that. At about 50 times next year’s earnings, the stock is not cheap. Morningstar has pegged Google’s intrinsic value at $254. Indeed, the upside would appear limited. For example, even if we assume the company can continue to grow earnings at a 30% for the next 5 years, it is conceivable the stock could reach $560 assuming a P/E of 15 at that time. It is trading at around $400 these days after reaching an all-time high of $430.

It is hard to argue against that. At about 50 times next year’s earnings, the stock is not cheap. Morningstar has pegged Google’s intrinsic value at $254. Indeed, the upside would appear limited. For example, even if we assume the company can continue to grow earnings at a 30% for the next 5 years, it is conceivable the stock could reach $560 assuming a P/E of 15 at that time. It is trading at around $400 these days after reaching an all-time high of $430.

However, in my opinion, those are conservative assumptions. Google has only begun to scratch the surface of its vast potential. As an example, think about the possibilities as broadband proliferates and video becomes a killer app on the net. Google will be a key player as our living rooms are digitized and we become perpetually connected through our wireless gizmos. It’s not just search and advertising. The company has proven its unbelievable potential by creating Google Earth and Google Desktop and other so-called ‘web services’ offerings are sure to follow.

I recently finished reading Phil Fisher’s classic book, Common Stocks and Uncommon Profits. I finally know what scuttlebutt means! It is no secret that Fisher’s investment approach has influenced Warren Buffett. They both agree that it is futile to try and predict where the market is heading or when the current business cycle may shift up or down. They both advocate holding onto winners and not following the crowd. And Buffett agrees with Fisher that diversification is NOT the recipe for reducing risk.

I recently finished reading Phil Fisher’s classic book, Common Stocks and Uncommon Profits. I finally know what scuttlebutt means! It is no secret that Fisher’s investment approach has influenced Warren Buffett. They both agree that it is futile to try and predict where the market is heading or when the current business cycle may shift up or down. They both advocate holding onto winners and not following the crowd. And Buffett agrees with Fisher that diversification is NOT the recipe for reducing risk.

What does Fisher have to do with Google? He had a fantastic track record of identifying growth stocks. One piece of advice he gives is that an investor should never assume that because a stock is trading at a high P/E multiple, that all the future growth is already discounted by the lofty valuation. In other words, do not underestimate the earnings power of what could be the next ultimate growth stock. This is what I see in Google and by now the stock has already appreciated more than four-fold since the IPO. The road may be bumpy and competition is heating up, but my back of the envelope calculations tell me the stock will appreciate by another 50% over the next five years. Any major decline in the stock should be used as an opportunity to snap up shares.

This weekend I came across commentary in the Wall Street Journal’s Breakingviews about the merits of breaking up Microsoft (NASDAQ: MSFT). I don’t agree with that proposition but that’s a topic of discussion for another time. The article also talked about Google and compared its valuation to that of Microsoft’s at the same point in the companies’ lifecycles. Indeed, Google’s shares are pricier than Microsoft’s were in their early days. The conclusion was that an investor buying into Google shares would not see the same upside as an investor that had bought into Microsoft shortly after its IPO.

It is hard to argue against that. At about 50 times next year’s earnings, the stock is not cheap. Morningstar has pegged Google’s intrinsic value at $254. Indeed, the upside would appear limited. For example, even if we assume the company can continue to grow earnings at a 30% for the next 5 years, it is conceivable the stock could reach $560 assuming a P/E of 15 at that time. It is trading at around $400 these days after reaching an all-time high of $430.

It is hard to argue against that. At about 50 times next year’s earnings, the stock is not cheap. Morningstar has pegged Google’s intrinsic value at $254. Indeed, the upside would appear limited. For example, even if we assume the company can continue to grow earnings at a 30% for the next 5 years, it is conceivable the stock could reach $560 assuming a P/E of 15 at that time. It is trading at around $400 these days after reaching an all-time high of $430.However, in my opinion, those are conservative assumptions. Google has only begun to scratch the surface of its vast potential. As an example, think about the possibilities as broadband proliferates and video becomes a killer app on the net. Google will be a key player as our living rooms are digitized and we become perpetually connected through our wireless gizmos. It’s not just search and advertising. The company has proven its unbelievable potential by creating Google Earth and Google Desktop and other so-called ‘web services’ offerings are sure to follow.

I recently finished reading Phil Fisher’s classic book, Common Stocks and Uncommon Profits. I finally know what scuttlebutt means! It is no secret that Fisher’s investment approach has influenced Warren Buffett. They both agree that it is futile to try and predict where the market is heading or when the current business cycle may shift up or down. They both advocate holding onto winners and not following the crowd. And Buffett agrees with Fisher that diversification is NOT the recipe for reducing risk.

I recently finished reading Phil Fisher’s classic book, Common Stocks and Uncommon Profits. I finally know what scuttlebutt means! It is no secret that Fisher’s investment approach has influenced Warren Buffett. They both agree that it is futile to try and predict where the market is heading or when the current business cycle may shift up or down. They both advocate holding onto winners and not following the crowd. And Buffett agrees with Fisher that diversification is NOT the recipe for reducing risk.What does Fisher have to do with Google? He had a fantastic track record of identifying growth stocks. One piece of advice he gives is that an investor should never assume that because a stock is trading at a high P/E multiple, that all the future growth is already discounted by the lofty valuation. In other words, do not underestimate the earnings power of what could be the next ultimate growth stock. This is what I see in Google and by now the stock has already appreciated more than four-fold since the IPO. The road may be bumpy and competition is heating up, but my back of the envelope calculations tell me the stock will appreciate by another 50% over the next five years. Any major decline in the stock should be used as an opportunity to snap up shares.

2 comments:

Posted by Amir

During the internet bubble, value investors used to say if your taxi driver is talking about buying amzn and ebay, then that is the time to liquidate your positions and get into something else.

This is how I feel about goog right now. Don't get me wrong, I fully regret not getting into the ipo. I was one of the guys who had goog on my radar screen two or three years BEFORE the ipo. My college TA and my friend's roommate were all google employees and I saw and heard all the buzz about goog in 1998! But leading up to the ipo, I just couldn't justify the hype and 40% jump immediately after the ipo. Again, what I regret is not trying to subscribe to the dutch auction.

Given all that, I think with today's stock price and what is happenning in the internet landscape, goog has become an even riskier stock to own. As I mentioned to my brother recently, I believe one of goog's achilles heel is the fact that the average user spends less than 30 minutes per visit on goog's site, vs. an astounding 4-6 hours for yhoo (see recent businessweek article with goog on the cover). This is directly related to the huge lead yhoo has over goog in providing content to the masses. I have been a yhoo stock owner for the last 5 years, and I'm willing to bet my brother that yhoo will outperform goog in the next 5 years.

Any takers? :-)

I think you are confusing two different issue here.

1. Is Google overvalued?

2. Which stock (YHOO or GOOG) offers better value?

I was not commenting on question number 2 in my post. I was simply stating that even at these levels, Google still offers some upside. I believe my 50% upside estimate over next 5 years is conservative.

I do not disagree that YHOO will outperform Google in that time span. In fact, I would guess that YHOO will outperform GOOG by a factor of two based on valuation.

I do not agree with you that GOOG is a "risky" stock. Any weakness in the shares should be used as an opportunity to accumulate shares. Will we see sub $400 again? I would be (pleasantly) surprised.

Post a Comment