- $816 million used for share repurchases (we repurchased over 6 million shares in the year at an average price of about $133 per share);

- $474 million used for capital expenditure reinvestments in our businesses;

- $318 million contributed to fund our legacy pension obligations;

- $282 million used to purchase an additional interest in Sears Canada. Our ownership level is now 70%, up from 54% last year; and

- $250 million used for net debt reductions as our domestic debt balance declined to $3.0 billion (or $2.3 billion excluding capital lease obligations).

Wednesday, June 13, 2007

Lampert and The Prince

Monday, April 09, 2007

Tracking Buffett 3

Since last May, Mr. Buffett has disclosed a substantial holding in Johnson & Johnson (NYSE: JNJ) as well stakes in Sanofi-Aventis (NYSE: SNY) and Unitedhealth Group (NYSE: UNH). These new positions are a play on demographics and the healthcare needs of ageing baby boomers. As a bonus, both JNJ and Sanofi are significant players overseas and provide a natural hedge against a potentially vulnerable US Dollar. Furthermore, they provide exposure to burgeoning emerging markets and their inevitable need for healthcare products and services. My brother and I have been a longtime JNJ shareholder and recently added Unitedhealth at around $53.

Berkshire has also added to its arsenal of construction and housing related holdings, including USG and ACME Brick, by taking a small position in Ingersoll-Rand (NYSE: IR), a manufacturer of climate control and HVAC systems among other things.

Meanwhile, Buffett has eliminated or reduced various positions in the portfolio. Lexmark (NYSE: LXK) and Gap (NYSE: GAP) are both gone. Lexmark's stock has made a nice comeback. Berkshire had doubled down on Lexmark after a monumental decline and probably broke even on that trade. In Q4 of 2006, Berkshire reduced its Comcast (Nasdaq: CMCSA) holding after a nice run up in 2006. We have been doing the same with our Comcast holding in the Model Portfolio.

Today, Mr. Buffett revealed 10.9% stake, at prices up to $81.8, in railroad operator Burlington Northern Santa Fe Corp. (NYSE: BNI). It appears he has taken smaller stakes in two other railroad operators as well. Indeed, in his recent annual report, he had mentioned two undisclosed positions worth a combined $1.9 billion. Railroads' fortunes have turned around significantly in recent years accompanied by improved operating efficiencies and pricing power. The railroads should continue to prosper as globalization leads to increased trade (import and export) and as energy demand (coal and natural gas) continues to rise. It is interesting to note that his good friend Bill Gates has a significant holding in Burlington's competitor Canadian National Railway (NYSE: CNI). Our exposure to the globalization and trade theme comes through Expeditors International of Washington (Nasdaq: EXPD) which we own both personally and in the Model Portfolio.

So as markets continue to fret over the possibility of a recession and a slumping housing market, Mr. Buffett is deploying his cash and finding value where others see trouble.

Monday, April 02, 2007

Cigs, Candy and Pop

"The one stock we should probably own is MO. I like the stub strategy. Basically, you buy MO and short KFT. When you receive the KFT spin-off shares, you cover the short position. This way you have created a 'stub' for the MO piece that will be left over afterwards. It's a common strategy to play spin-offs."

If you want to learn more or refresh your memory about the wonderful world of spin-offs, refer back to or order yourself a copy of Greenblatt's book. In this case, on March 22nd, Altria was trading at around $86. Kraft was trading at around $32. So you could have created the 'MO Stub' at about $57.5. Meanwhile, Altria When-Issued shares (which excluded the Kraft portion) were indicated in the mid $60s. At least based on that information, you would be looking at a neat 13% return. Indeed, Altria ended today above $68 as a standalone. Kraft ended below $32. Ignoring the slight gain on our short position, this trade would have resulted in an annualized gain in excess of 270%. Not bad. There goes the Efficient Market Theory again.

In any case, apologies for not writing about this earlier. It would have made for a nice arbitrage opportunity. Here are a few more you may want to consider. One is the upcoming and confirmed split of Cadbury Schweppes (NYSE: CSG). Our friend Nelson Peltz is at it again just as he did with Heinz (NYSE: HNZ), a former Model Portfolio holding. He has amassed a 3% stake. Cadbury will be split its candy and beverage businesses. Who hasn't heard of Trident gum and 7 Up or Dr. Pepper? The confectionary business would be a shoe in for a merger and private equity players must be salivating at the prospects of owning the beverage business. Upon news of Peltz's move, the stock rocketed 10% or so and has inched up since. But dig around a little and you may be surprised to find that a hefty 10%-25% return has been left on the table, based on a sum of the parts analysis, even after the recent run up in the shares.

The other opportunity has nothing to do with cigarettes, candy or pop but has everything to do with the business of security. Brinks Co. (NYSE: BCO) has been the recent recipient of much attention from the hedge fund activists including Pirate Capital and MMI Investments which have taken sizable positions in the company. Pirate's founder eventually got his way and was given a seat on the Board. Since then this one seems to be flying under the radar a bit. Meanwhile, the folks at MMI have been kind enough to share their diligence with us. A bit of sleuthing on the SEC web site and you will come across a set of slides filed by MMI laying out various scenarios under which Brinks management would be able to increase shareholder value. Let me know if you would like me to send the file to you. Needless to say you could be staring at a 10% - 25% return on your investment if you buy the shares at a current $63 with manageable downside risk. So as we did with Harrah's (NYSE: HET), if you are sitting on some cash, you may want to park some with the folks at Brinks.

Saturday, March 17, 2007

氣質

But look deeper and you may find that this was just a healthy correction after many consecutive months of gains. Maybe more declines are in store. That would be just fine with us too. Let's take a look at the various elements which instigated the downdraft.

The collapse of the Chinese stock market that was all but driven by retail investors has literally no impact on the growth of the Chinese economy. For now manufacturing, income growth and creation of jobs are all that matter. The priority for the authorities is to prevent the economy from overheating. In fact, the attempt to drain liquidity from the economy was one cause of the sell-off.

As for Mr. Greenspan, he was quick to qualify his comments by saying that while a recession was possible, it was not probable. Thank you very much.

The troubles in subprime mortgages may have more damaging effects and could spill over to other parts of the economy. The already fragile housing markets may be broadly affected. Or investors' appetite for risk may diminish, spelling doom for the private equity powerhouses relying on the junk bond market to make the math work. Perhaps, but in my opinion unlikely.

If the private equity players, hedge funds and activist investors were giddy before the market's decline, they must be salivating at their prospects now. Surely, the discount to intrinsic value of companies such as Brinks Co. (NYSE: BCO) and Cadbury Schweppes PLC (NYSE: CSG), being pursued by hedge funds and activist investors, has not disappeared over night.

Then there is Carl Icahn's recent bid for WCI Communities Inc. (NYSE: WCI). Who in their right mind would want to buy a homebuilder now? Let's just say Mr. Icahn has done just fine buying up assets when all others have shunned them. If you are not satisfied with Mr. Icahn's track record, you may be interested in what the folks at Goldman Sachs (NYSE: GS) had to say during their recent quarterly conference call. Goldman did not seem worried and proclaimed that "while market conditions will regularly shift, we are confident that our client-driven strategy will continue to produce the strongest results for the firm." Oh by the way, Goldman is ramping up its subprime operations and is on hunt to snap up distressed subprime lenders on the cheap.

If Mr. Icahn and Goldman are not good enough, let me fall back on our most reliable mentor Warren Buffett. In an interview with Liz Claman of CNBC last week, Mr. Buffett rewarded us with his usual wisdom. It's worth a listen. Here are a few excerpts:

"Long term you will do just fine owning American equities. I have no idea what the market will do next week or next month or next year. Zero. I don't think about it and if I thought about it, it would do no good. The main thing an investor needs is the proper temperament. He doesn't need a 150 I.Q. He doesn't need to be an expert in accounting. But he does have to keep his balance when untoward things happen in the market. The reason investors do poorly in the market is they beat themselves. The Dow went from 66 to 11400 over the past century. You would think it would be hard not to do well over that period ... You have to have emotional stability. And if you have emotional stability and stick with American businesses you will do fine."

"I don't think about the economy. It doesn't make any difference to me because I am going to buy a business and be with it forever. I have never in my life not bought something because I thought the economy is going to get poor and I have never bought something I didn't like because I thought the economy was going to be great for a while. We are going to play the game as long as I am alive. There will be mostly good years, there will be a few sensational years and there will be a few terrible years. I can't dance in and out and skip the terrible years."

"[Berkshire's] own businesses right now are pretty good but the residential construction businesses - the carpet business and the bricks business - have headed down in a significant way. But it doesn't make any difference. We are going to be in the carpet and bricks business forever."

Icahn, Goldman and Buffett. All sucessful investors with the proper temperament. In case the bottom falls from under the Chinese markets again, remember the Chinese word for temperament - 氣質.

Tuesday, February 27, 2007

GaveKal

GaveKal’s thesis rests on the prospects of the “platform company” or “Sizzle Inc.”, as Barron’s characterized it, which has outsourced the volatile portions of its operations such as manufacturing to become leaner, more productive and, indeed, more profitable than ever. As discussed in a recent Wall Street Journal article, the resulting reduction in economic cycle volatility has been dubbed the “great moderation” by economists. GaveKal provides an in-depth analsyis of why what is happening really is 'different this time' in a must read book titled Our Brave New World co-authored by the firm’s founders.

GaveKal’s thesis rests on the prospects of the “platform company” or “Sizzle Inc.”, as Barron’s characterized it, which has outsourced the volatile portions of its operations such as manufacturing to become leaner, more productive and, indeed, more profitable than ever. As discussed in a recent Wall Street Journal article, the resulting reduction in economic cycle volatility has been dubbed the “great moderation” by economists. GaveKal provides an in-depth analsyis of why what is happening really is 'different this time' in a must read book titled Our Brave New World co-authored by the firm’s founders. Instead of building that next plant, corporations are spending more than ever on research and development, which by the way is considered an expnse and not an investment, to be on the leading edge of innovation. Then there is the supposed negative American household savings rate which conveniently fails to take into account spending on healthcare and education, not to mention the rising value of retirement and brokerage accounts. Indeed, contrary to the official figures reported in the press, the U.S. national wealth continues to grow. So is the world's for that matter. Notwithstanding the possibility, or perhaps the inevitability, of a slowdown (earlier today the Chinese stock market declined by 9% while the Dow, Nasdaq and the S&P were all taking a beating to the tune of more than 3% each), the U.S. will always offer the political and economic stability that has been so attractive to the inflow of foreign capital which so many are afraid will one day dry up, ceasing to support the U.S Dollar from a monumental crash.

I am not one to argue with the venerable Alan Greenspan who yesterday warned of a possible recession towards the end of 2007. But instead of trying to time Mr. Market, for those us with a long-term view, it may suffice to enjoy an afternoon coffee, reading GaveKal’s tome and contemplating how best to allocate our investments among GaveKal’s four recommended asset classes: 1. Cash or gold, 2. Emerging markets or commodities, 3. Platform companies and, 4. High quality government bonds. Hint: you should be overweight in platform companies. Wal-Mart (NYSE: WMT) anyone?

Wednesday, January 31, 2007

Slick Reality

Numerous articles have been written about reduced oil demand due to high prices, pegging last summer as the tipping point. Others have tried to figure who will be hurt and who will benefit from the decline in prices. It is somewhat ironic that in the middle of all this volatility, the viability of alternative sources of fuel such as ethanol has come under scrutiny. Lower oil prices in conjunction with rising corn prices make ethanol’s economics much less attractive. But ethanol is another topic for another day.

Analysts and experts appear to be ignoring a multitude of signals and data points which should allay any fears of a dooms day scenario. Of course, this means Mr. Market may be providing us with a few attractive opportunities in the energy sector.

Second, there is the minor issue of supply and demand. Many opine that based on supply and demand economics alone, ignoring geopolitical factors, oil prices should be at $40. That may be accurate but good luck eliminating those risks altogether. If it was a forgone conclusion, President Bush would not have felt compelled to ask for a doubling of the U.S. Strategic Petroleum Reserves. Apart from this risk premium, the supply/demand imbalance is far from over. A recent guide provided by The Wall Street Journal titled “Unreliable Spigots, Mighty Thirsts” highlighted the precariousness of the world’s oil supply and the insatiable appetite for oil. The

Third, there is the flow of smart money into energy assets. General Electric (NYSE: GE) recently purchased oil services company Vetco Gray for $1.9 billion. Goldman Sachs (NYSE: GS) and Morgan Stanley (NYSE: MS) are teaming up to buy the oil and gas assets of Dominion Resources Inc. (NYSE:D) for $15 billion. And yes, there is Mr. Buffett’s $1 billion bet on ConocoPhillips (NYSE: COP). These investors should realize above average returns on their investments without requiring sky high oil prices. Indeed, current oil price levels would suffice. The U.S. Department of Energy’s forecast is for oil prices to dip to $47 a barrel in 2014, rising to $57 in 2030. Keep in mind these prices are well below oil’s 1980’s peak price on an inflation-adjusted basis.

Those three reasons have convinced my brother and I to build a position in ConocoPhillips over the last several months at an average price of $64. The stock trades at just 7 times 2007 earnings estimates. The knock against the stock is its heavy debt load compared to peers, its willingness to pay up for acquisitions and its exposure to such risky locales as

Monday, January 22, 2007

The Librarians

“Ben Graham taught me 45 years ago that in investing it is not necessary to do extraordinary things to get extraordinary results.”

Warren Buffett, Berkshire Hathaway, 1994 Chairman’s Letter.

There is no shortage of investment disciplines, philosophies and methodologies out there. There are those who look at companies’ fundamentals, there are those who read charts and then there are the quants. The quants gather gobs of data, form hypotheses which are tested against historical data and tweak their computer models to forecast future returns. We all know how reliable past performance can be as a predictor of future returns. In his 1990 Chairman’s Letter, Warren Buffett wrote, “Beware of past-performance ‘proofs’ in finance: If history books were the key to riches, the Forbes 400 would consist of librarians.”

To be sure, venerable quantitative shops such as Renaissance Technologies Corp. and D.E. Shaw have amassed enviable track records and kept their investors happy. One has to wonder though if the market has not ironed out the inefficiencies which have been exploited by these whizzes over the past two decades.

It is interesting that D.E. Shaw’s web site has a section on Qualitative Strategies noting that a large share of the firm’s attention is now spent on identifying “profit opportunities by human experts” and that such strategies “have accounted for much of the firm's growth over the years, and now represent an equally important element of its strategic focus.” Renaissance’s site is too exclusive to post any such information.

Then there was the recent Businessweek article, “Outsmarting the Market”, profiling Barclays Global Investors (BGI), the subsidiary and quant group of parent Barclays PLC. Impressive indeed. $19.9 billion of above market returns or “alpha” over the past five years. 2800 pension funds and institutional investor clients. Billions under management - $370 billion to be exact. Alas, all the fancy research, hypotheses and models for a mere 1.64% above market return on average. This is done by spreading bets across a wide numbers of investments. The idea of a concentrated portfolio is taboo to say the least since that would entail too much price volatility, which as we have discussed before, is wrongly equated with risk.

The quants don’t care much about the companies they are ‘investing’ in. Businessweek writes that the “whole sprawling human drama of business is of no interest to Barclays’ researchers, who never venture out to call on a company or tour a store or a factory.” I wonder if it was the same lack of analysis that lead to Barclay’s acquisition of BGI for $443 million in 1995.

Tuesday, January 02, 2007

AA Value Fund Update

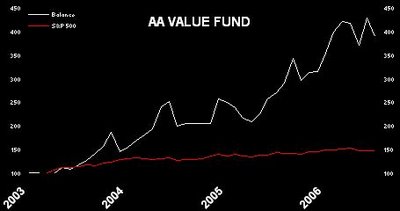

The S&P 500 was flat from June to July and began its climb in August. The Fund actually ended August below its July level before mounting a comeback. As I had noted in my last update, the Fund was heavily weighted in the NYSE Group at the time(NYSE: NYX). While we made out OK with that position, we made the mistake of selling it too soon. Had we held on through the end of the year, the Fund's performance would have been stellar. Since August we also took positions in Mueller Water Products (NYSE: MWA) which is also a holding in our Model Portfolio and Harrah's (NYSE: HET) which I wrote about earlier. Mueller at below $14 was too good to pass on and the Harrah's story played as we anticipated with a winning bid of $90 being accepted by the company's Board.

For 2006, the Fund was up 59.7% vs. S&P 500's 13.6% increase. This brings the Fund's CAGR since the beginning of 2003 to 49.3% vs. S&P 500's 13.5% return. I have not made any additional capital contributions to the Fund since 2003.

Our current holdings include Intel (Nasdaq: INTC), Expeditors International of Washington (Nasdaq: EXPD), Leucadia National (NYSE: LUK) and Western Union (NYSE: WU).

Our current holdings include Intel (Nasdaq: INTC), Expeditors International of Washington (Nasdaq: EXPD), Leucadia National (NYSE: LUK) and Western Union (NYSE: WU).The Dressing, The Dog and The Herd

The end of year provided for some very entertaining reading and tube watching. There were articles galore about end of year portfolio strategies – from tax loss selling to window dressing of portfolios by professional money managers. Among the stocks potentially being dumped, according to a December 26th Wall Street Journal article would be Corning (NYSE: GLW) which we have talked about before and is a holding in our Model Portfolio.

Then there was the Wall Street Journal article on December 2nd talking about the oh-so invincible hedge funds who felt they should catch up by unwinding bearish positions and joining the rally. Who says the markets are efficient?!

On another day in December, CNBC had a special on the Dogs of the Dow strategy. That’s the strategy which dictates you buy the 10 worst performing Dow stocks for the upcoming year. Unfortunately for the Dog people, as laid out in another December 26th WSJ article, real losers may be hard to find. Only 4 of the bottom ten actually finished below their 2005 levels. Intel (Nasdaq: INTC), one of our favorite picks and a Model Portfolio holding to which we added to recently, got the honor as THE worst performer of the Dow with a 19.55% decline.

Amid all of this, I wonder what Mr. Jon Brorson has been up to lately? Mr. Brorson was profiled in a rather amusing article in the WSJ on September 29th as the Dow was mounting a fierce rally from a July low of about 10,700 to 11,700. He has $2.3 billion under management and apparently has a knack for timing market turns. Oh boy. That’s a recipe for stress if I have ever seen one. The article notes Mr. Brorson’s day begins at 4:50 am and ends by going to bed by 9 pm – “I am wiped out when I get home each day,” proclaims Mr. Brorson. No wonder. Checking the leading sectors every hour and eyeing stock charts by drawing horizontal lines across the peaks and valleys can do that to you. Hopefully he didn’t cut back too much on that Phelps Dodge (NYSE: PD) position which ended the year 40% higher from its September levels after becoming a taekover target. Unfortunately, Mr. Brorson appears too worried about the herd and “knows that if the market keeps defying his expectations, he will at some point be forced to start buying the winners, or risk falling behind.”

I say hold the dressing, love THE dog and ignore the herd.

Sunday, November 26, 2006

Nancy's House

Let me be clear. Whether the government is run by Democrats or Republicans does not change much when I am deciding to buy Berkshire Hathaway (NYSE: BRKB) shares for my son’s college savings account. Neither will the actions of the soon to be Speaker of the House, Ms. Nancy Pelosi. But it sure will be fun to watch what she will do next when it comes to

Source: The Wall Street Journal

An article in the Wall Street Journal about her stance towards

An article in the Wall Street Journal about her stance towards

She should be reminded that the

Suggestion for Ms. Pelosi – have a nice dinner with Treasury Secretary Henry Paulson to learn about what it takes to have a cordial and constructive relationship with the Chinese. Whether Ms. Pelosi likes it or not,

Thursday, November 23, 2006

SHEETROCK

"We remain agnostic about the market. We light a candle and hope it goes down. Only during periods of stress can you find good companies at reasonable prices."

Timmy and Wendy Part Ways

Late Septmeber was the big date. Wendy’s (NYSE: WEN) finally let go of Tim Hortons (NYSE: THI). The call earlier this year to buy Wendy’s shares before the spin-off was completed has turned out well with a return of about 30%. Tim Hortons shares languished after the partial spin-off and launch of its IPO but are trading near an all-time high now that the spin-ff has been completed. The stock may not be cheap but you are holding on to a valuable brand and a franchise which should be able to provide shareholders with sustainable growth for some time.

Meanwhile, it didn’t take Mr. Market too long to realize that it was valuing Wendy’s portion of the business too pessimistically pre spin-off. Wendy’s shares began inching up almost immediately after the split. The script is playing out almost to perfection. The Baja chain has been jettisoned and Wendy’s has announced a $1 billion share buyback program including a recently completed Durtch auction to vacuum up 19% of outstanding shares. Thank you very much. If management can execute its turnaround strategy from here, shares should have another 30% upside from here.

Sears Capital LP

OK, so that entity doesn’t really exist. At least I don’t think it does. But Sears Holdings (Nasdaq: SHLD) does. I first wrote about Sears and Eddie Lampert in October 2005. The stock is up about 50% since then and may not be the bargain it was back then. But it’s too early to bail.

Mr. Lampert has kept his word and emphasized profitability over top-line growth (sales are declining) while adding to his cash pile. As predicted, Mr. Lampert is also beginning to take advantage of the freedom he has been given by the Board to use the cash for acquisitions and investments as he sees fit. Last week’s earnings announcement showed a handsome profit from Mr. Lampert’s investment activities using fancy, albeit risky, derivates known as total-return swaps. It is still early in the game and I would venture to bet that Mr. Lampert is looking to make a more substantial move. I am not sure if I believe rumors that he has been sniffing for an acquisition with potential targets being companies like Anheuser-Busch (NYSE: BUD) and Home Depot (NYSE: HD). No matter. Over the past 18 years he has proven to be a worthy investor, perhaps, dare I say, as good as Mr. Buffett. This ride may be bumpy but I think patience will be richly rewarded in the long-term.

Wednesday, November 01, 2006

3 and 30

Mr. Buffett: "Why do you charge 2 and 20?"

Hedge fund manager: "Because I can't get 3 and 30."

The Dow surpassed 12,000 a few weeks back without the fanfare one may have expected. The hoopla surrounding Dow 10,000 was curiously absent this time around. The recent advance seems orderly and justified.

Still, some are partying hard, maybe too hard, on Wall Street these days. The $1.2 trillion hedge fund industry and the $1 trillion private equity folks are going bananas. The Hedgies are making fancy trades and the Barbarians are accepting lower returns while loading on the debt. Where this will all end is anybody’s guess.

To be sure there are signs that the system is beginning to cleanse itself. The recent implosion of various high profile hedge funds may be the beginning. Amaranth went down in flames playing around with natural gas and others are closing shop, taking a break or getting hammered by placing wrong bets on bonds and direction of interest rates. How people expect to consistently return 20% or 30% or 50% to their investors in beyond me when some of the best investors of our time have been happy beating the market by a handful of percentage points over time. It amazes me when people tell me such and such hedge fund is up 50% year to date. At that rate, the fund manager should displace Mr. Gates on the Forbes richest people in the world in no time. Brace yourselves.

I recently finished reading Adam Smith’s (George J.W. Goodman) Supermoney. I wish I had read this book before the .com bubble burst. The environment of the late 60s was eerily similar to the late 90s. Companies with negligible or nonexistent earnings were going public and trading at crazy multiples. Money managers were promising outsized returns. The accumulation of supercurrency – stocks and options – was the name of the Game. It all ended badly with the 1973 – 1974 bear market. In a July 1999 Book Review article in the New York Times Mr. Smith wrote:

I recently finished reading Adam Smith’s (George J.W. Goodman) Supermoney. I wish I had read this book before the .com bubble burst. The environment of the late 60s was eerily similar to the late 90s. Companies with negligible or nonexistent earnings were going public and trading at crazy multiples. Money managers were promising outsized returns. The accumulation of supercurrency – stocks and options – was the name of the Game. It all ended badly with the 1973 – 1974 bear market. In a July 1999 Book Review article in the New York Times Mr. Smith wrote:

Within living memory, a billion dollars was real money. We can see why - if not when - our own trillion-dollar bubble will pop: even though the Internet itself will grow as a mighty force, if the market will give a billion-dollar value to a two-year-old company losing money, then the efforts of a diligent populace will be put to creating such companies, until the supply of those companies overwhelms the demand for them. The seasons turn and all the rivers flow into the sea. We read these histories and we know the ending. Yet such is the intensity and excitement of manias that they never lack for participants.

Good call indeed. Incidentally, Supermoney has the distinction of being the first book to introduce Mr. Buffett to the world. At the time, Benjamin Graham had approached Mr. Smith to work on a new edition of The Intelligent Investor which led Mr. Smith to visit a so-called Warren Buffett in

A leading investment manager of a billion dollar fund had delivered himself of a statement that money management was a full-time job, not only week by week and day by day; “Securities must be studied on a minute by minute program.”

“Wow!”

It gets better. Perhaps not surprisingly, the teachings of Benjamin Graham were in question by the hotshot money managers of the time. Mr. Buffett’s response in a letter to Smith:

“Graham’s teachings,” he wrote, “have made a number of people rich, and it is difficult to find any cases where those teachings have made anyone poor. There are not many men you can say that about.”

We all know who has had the last laugh some 25 years later!

All of which brings us back to the Hedgies and the Barbarians. I don’t know how all this will end. To be sure, the markets seem to be absorbing the shocks quite well. The Amaranth news barely put a dent in the market and other hedge funds are undeterred. And word is that the private equity players really know what they are doing this time around. But it all makes me uneasy. The Game we play in pursuit of supercurrency is taking place in a continuously evolving arena and is all about accumulation of wealth. To play the Game right, you must take advantage of the follies of Mr. Market and you must have a long-term contrarian perspective on things without getting caught up in the emotional roller coaster of the moment. In the meantime, in the words of Adam Smith, “If you are still for the Game, why, may you prosper; I wish you the joys of it.”

Tuesday, October 24, 2006

Wednesday, October 11, 2006

Harrah's Arbitrage

“[O]

Warren Buffett, 1988 Chairman’s Letter

In his 1988 Chairman’s Letter, Buffett allocated one section to arbitrage. He considers risk arbitrage a short-term substitute for cash, assuming of course that the transaction will provide a probability adjusted return in excess of the risk-free rate. At least back then,

This brings us to the recent buy-out offer for Harrah’s Entertainment (NYSE: HET) by a private-equity group which may offer an intriguing arbitrage opportunity. On October 2nd, news broke out that Harrah’s had received an offer for $81. The shares leapt from a previous close of $66.43 to a high of $80.01 before closing at $75.68. The seemingly wide gap between the stock’s closing price and the offer price is attributable to the uncertainties about the deal closing (financing, management’s refusal to sell, etc.) and the time it may take to close the deal. The casino licensing requirements alone could take up to a year and prove a challenge, although certain waivers could apply to institutional investors thus reducing some of the uncertainty. You are probably thinking a 7% potential return is not much of an arbitrage opportunity. But you know I am not a proponent of Efficient Market Theory. Just because the market says 7% is the best you can do, it doesn’t mean it’s so. Here is why.

I expect the initial $81 offer to be just a starting point (in fact the offer was raised to $83.5 today but the stock settled back near $76 after opening above $77). If you read the Wall Street Journal article on October 3rd, you will note that as early as September 15th, the buyers were exploring the casino licensing requirements in

The fact that they granted a waiver weeks before an offer was submitted also demonstrates that an offer was not unwelcome. Indeed, given Harrah’s was one of the cheapest casino stocks among peers, perhaps management got tired of Mr. Market’s treatment and decided to go about its business as a private entity instead. The trick will be to make existing shareholders happy by putting up a ‘fight’ and demanding a higher price from the buyers. Perhaps this smells of conspiracy theory to you but I don’t find it too farfetched.

Let’s assume the deal will take a year to close. The probability of a deal closing is quite high. Even if the deal falls through, the cat is out of the bag. Shareholders would demand that management maintain and boost the current stock price through a special dividend or buybacks. For example, this could be financed by borrowing against the company’s vast real estate holdings – apparently a strategy contemplated by the buyers to fund their buy-out. Furthermore, there is a high likelihood that other suitors will emerge boosting the offer price further. I think the private equity players can pay up to $86 and still enjoy a nice free cash flow yield given that Harrah’s is a cash machine. Finally, Harrah’s pays close to a 2% dividend. Add all that up and the shares look like a nice place to park some of your cash at $76 a share until you find a juicy long-term opportunity.

Saturday, September 30, 2006

Model Portfolio

We will have monthly updates on the portfolio and I will let you know if I make any changes before each monthly update. Approximately $180,000 has been invested so far and we will add cash to the portfolio until total invested capital equals $200,000. On a pre-tax basis and including commissions, this portfolio would have handily beat the S&P 500 since last September. I have assumed each position was added to the portfolio in two transactions. We will hopefully continue this streak going forward. Please remember that the Model Portfolio and the AA Value Fund are separate. The latter is a super concentrated portfolio which I will occasionally update you on as I have in the past.

Tuesday, September 12, 2006

Seth Klarman

Margin of Safety - Investing at considerable discounts to underlying value, an individual provides himself or herself room for imprecision, bad luck, or analytical error (i.e. “margin of safety”) while avoiding sizable losses

Seth Klarman, Margin of Safety, Glossary, 1991

Seth Klarman’s Margin of Safety has been getting some press lately. The book was highlighted in an article in the August 7th issue of BusinessWeek. The Globe and Mail featured an article on the book on August 12th.

Seth Klarman’s Margin of Safety has been getting some press lately. The book was highlighted in an article in the August 7th issue of BusinessWeek. The Globe and Mail featured an article on the book on August 12th.

I had found out about Klarman and his book years ago while I was researching investment books to buy to add to my library. However, the book has been out of print since 1991. You can buy a used one at Amazon these days for about USD $1,000. No thank you.

So you can imagine why I was in disbelief when one day in early August I found myself walking down

Carl’s books were stacked on top of each other in the corner of his office. I took a quick glance and recognized a bunch of them. But I hadn’t noticed Klarman’s book. When Klarman later came up in conversation, Carl offered to lend me the book. Thanks Carl.

The book is a quick read and it is a classic. Klarman is a true Graham disciple. There is a fantastic chapter on investing in distressed and bankrupt securities. He emphasizes the importance of holding cash and being patient, the need to evaluate one’s portfolio against emerging investment opportunities which may be better bargains, and why it is crucial to ignore Wall Street’s latest financial innovations and gimmickries. There is also a section on a very important principle which many investors fail to grasp: “the first 80% of the available information is found in the first 20% of time spent.” Digging in too much can mean lost opportunity. As long as you leave yourself a decent Margin of Safety, you will be fine.

Klarman does an excellent job making the case for value investing and how one may profit by adhering to the discipline. However, he reminds us that not everyone is wired to succeed at it. Being a contrarian can be a lonely and psychologically challenging endeavor at times. Here is the conclusion of the chapter on value investing and the importance of Margin of Safety: “Value investing is simple to understand but difficult to implement. Value investors are not supersophisticated analytical wizards who create and apply intricate computer models to find attractive opportunities or assess underlying value. The hard part is discipline, patience, and judgment. Investors need discipline to avoid the many unattractive pitches that are thrown, patience to wait for the right pitch, and judgment to know when it is time to swing.”

Monday, August 28, 2006

Miller Time

“The call is much harder from here, with only scattered Stone Age tribes in the Amazon, the comatose, or newly arrived aliens from Alpha Centauri, unaware that energy stocks are a one way ticket to outperformancedue to demand from China and India, the location of reserves in unstable areas, thelack of investment in new refining capacity, the rate of depletion, the dwindling ability to locate giant new fields, and so on.”

Bill Miller on Value Trust’s lack of exposure to energy stocks, July 2006

Bill Miller is well known for his outstanding record of beating the S&P 500 for 15 years in a row. He manages the Legg Mason Value Trust and is considered a value investor, although you may not agree with that designation given 20% of his portfolio is invested in internet companies including Yahoo (Nasdaq: YHOO), eBay (Nasdaq: EBAY), Amazon (Nasdaq: AMZN) and Google (Nasdaq: GOOG). He thinks the first three are trading at 50% of fair value – my brother and I agree and have added to our eBay position and considering adding to our Amazon holdings.

The press is having a ball these days speculating if the run is finally coming to an end as Miller’s portfolio has been decimated so far this year. Miller has admitted as much and in July wrote a letter to his investors reminding them to think long-term and that his portfolio looks different from the index, and may therefore underperform significantly at times, for a good reason: to beat the index you have to look different from the index. In his letter he admitted he was too early to get into homebuilder stocks such as Centex (NYSE: CTX) and Pulte (NYSE: PHM) and that he missed out on energy stocks. Another possible reason to speculate an end to his spectacular run may be that his fund has gotten too big. After all, Buffett has said that “a fat wallet is the enemy of superior investment results.”

In any case, it seems Miller is not alone. Other value managers are singing the same tune. In late June, Bill Nygren of the Oakmark Fund gave a speech at a Morningstar Conference in which he laments the short-term focus of financial media, echoed by Miller in his letter noting the “market’s myopic, obsessive focus on what is going on for the next three to six months.” Oakmark’s recent absolute returns have been nothing to balk at, but Nygren has been underperforming the market. One culprit has been his lack of exposure to energy stocks. The other is his decision to begin buying what he classifies as superior businesses at reasonable prices beginning in 2003.

He provided some interesting data in his slides and focused on 10 stocks Oakmark finds interesting. Stocks we have talked about and included on the list are Wal-Mart (NYSE: WMT), Citigroup (NYSE: C), Home Depot (NYSE: HD), and Tyco (NYSE: TYC). Consider this. These ten stocks have declined 42% vs. S&P 500’s 19% decline from its peak in 2000. Meanwhile, S&P earnings have increased 67% since 1999 vs. 161% for the ten companies. Moreover, on a P/E basis, they are trading at about par with the market. In other words, they are priced as if they are average businesses. If the market is right, well, then they are priced accordingly and Nygren views this as his margin of safety. Otherwise, higher earnings growth and a P/E expansion should reward him (and us) handsomely.

Nygren for one was vindicated after the bubble burst in 2000 as investors who had bailed on him to buy tech-havy funds wished they had stuck with him. Perhaps most importantly, both Miller and Nygren have skin in the game and are invested in their funds. During his speech, Nygren reminds us that it is practically impossible to avoid mistakes when investing. The secret to success is to consistently apply your investment philosophy and discipline over the long run and to stay patient.

Lou Simpson

Lou Simpson, GEICO Insurance

In The Warren Buffett CEO, Robert P. Miles introduces Lou Simpson as Berkshire Hathaway’s (NYSE: BRKB) back-up capital allocator. Simpson operates very much under the radar and is in charge of equity investments at GEICO, one of

In The Warren Buffett CEO, Robert P. Miles introduces Lou Simpson as Berkshire Hathaway’s (NYSE: BRKB) back-up capital allocator. Simpson operates very much under the radar and is in charge of equity investments at GEICO, one of

It took a while to get through this book. There is a lot of repetition with praise for each of the CEO’s of the various subsidiaries and their admiration for their boss. But in my opinion, the real message to take away from this book is that

The chapter on Lou Simpson alone makes this a worthwhile read. His business tenets are listed by Miles as follows:

- Read company reports and financial press voraciously. He reads 5 to 8 hours a day. His favorites are the Wall Street Journal, BusinessWeek, Fortune, Forbes and Barron’s. All must reads.

- Research any company extensively before making an investment.

- Don’t overpay.

- Think independently.

- Invest for the long-term.

- Hold only a few stocks. He thinks individual investors should hold no more than 10 to 20 stocks. We have talked about this before.

Remember our discussion about value vs. growth last October? It seems Mr. Simpson agrees with us: “When you ask if someone is a value or growth investor – they are really joined at the hip. A value investor can be a growth investor because you are buying something that has above-average growth prospects and you are buying it at a discount to the economic value of the business.”

Since we are talking about equity investments atSunday, August 06, 2006

Short-Termism

"In the short run, the market is a voting machine but in the long run, it is a weighing machine".

Benjamin Graham, The intelligent Investor

A recent study by the CFA Centre for Financial Market Integrity and the Business Roundtable Institute for Corporate Ethics recommended companies stop giving quarterly guidance to encourage long-term thinking among managers, analysts to stop demanding short-term results and for asset managers to have their own wealth tied up in funds they manage.

It’s about time people start to pay attention. Indeed, a few companies are starting to back away from providing guidance. All this mumbo jumbo about missing analyst consensus by a penny or not meeting the whisper number is ludicrous. Meanwhile, ‘investors’ have punished shares of 3M (NYSE: MMM) and United Parcel Service (NYSE: UPS) in recent weeks even though the long-term prospects for those businesses are more than just average.

For long-tem investors, this behavior simply creates opportunity. The key is to be patient and have the discipline to believe in your investment thesis and not be swayed by short-term fluctuations in prices. Speaking of fluctuations, the market has provided a fun ride since March. After reaching its highest level in years in May, the S&P 500 fell by more than 7% at some point in June before recovering some of the lost ground and has been practically flat on a monthly basis from May to July. Our ‘value fund’ was also whipsawed during this period but recovered sharply in June thanks to a spectacular run in the shares of the NYSE Group (NYSE: NYX) which seem to have been battered for no apparent reason.

We are weighted heavily in these shares and still believe the shares are undervalued at these prices. Meanwhile, Atticus Capital LP, disclosed on Friday that it has almost doubled its holding in the NYSE Group and now owns just over 7% of the company with options to buy more shares. The firm also has stakes in Deutsche Boerse and Euronext, which has agreed to a $10 billion merger with NYSE. The deal is not done by any means as Deutsche Boerse remains a dark horse and could still derail the agreement. Stay tuned.

We are weighted heavily in these shares and still believe the shares are undervalued at these prices. Meanwhile, Atticus Capital LP, disclosed on Friday that it has almost doubled its holding in the NYSE Group and now owns just over 7% of the company with options to buy more shares. The firm also has stakes in Deutsche Boerse and Euronext, which has agreed to a $10 billion merger with NYSE. The deal is not done by any means as Deutsche Boerse remains a dark horse and could still derail the agreement. Stay tuned.

Charlie and Warren

I am a bit late with this one. But for you die hard value investors and Buffet fans, you have to check Charlie Rose’s three part series on Buffett. The Man, the Company and The Gift are well worth watching, especially the first two. You can find them on Google Video. I have ordered the DVD’s and will add them to the curriculum my son will surely have to complete before he makes his first ever investment. For now, as a 10 month old, he will have to trust his father. Tomorrow, he will be the proud owner of one share of Berkshire Hathaway (NYSE: BRKB) Class B share in his newly opened college savings account.

Sunday, July 16, 2006

α + β

There is also a non-systematic component to risk which is specific to the business you are investing in. Outperforming the market will depend on how well you mitigate this kind of risk. You certainly can't diversify it away by holding 150 stocks in your portfolio as many mutual fund mangers on Wall Street tend to do. As we have discussed before, the way to go is to build a concentrated portfolio which contains businesses you really understand and bought after a lot of thought and due diligence.

Apparently, there is another way to accomplish this and it involves Alpha. Wall Street firms' ability to conjure up portfolio "strategies" which puts more fees in their pockets is once again on display here. A recent Wall Street Journal article explained how "Portable Alpha" works. The most recent issue of Institutional Investor also had an insert which devoted a section to "Alpha Beta Separation" strategies. What is all the hoopla about? Here is how it's supposed to work. Clients are advised to get exposure to their benchmark index (Beta) through the use of derivatives, freeing up cash to allocate to Portable Alpha - money managers using hedge fund type strategies to boost returns above and beyond the Beta portion of the equation. You got it. The whole pie in the sky pitch assumes that these money managers will consistently beat the market. Well, that just doesn't happen (see Dreman's book for more details). Oh, and I forgot to mention that proponents of Portable Alpha charge hedge fund type fees to boot. It doesn't get any better than that. The Journal noted that "critics say portable alpha is nothing but Wall Street hocus-pocus that lets money managers rack up higher fees." They took the words right out of mouth.

Wednesday, July 12, 2006

The Weather Channel

A recent Wall Street Journal article highlighted the fact that demand for catastrophic reinsurance products is outstripping supply. Meanwhile, hedge funds and private-equity firms are filling the gap by providing coverage in certain cases. But don’t forget the king of reinsurance, Warren Buffett. Indeed, Berkshire Hathaway is making a big bet on mega-cat reinsurance even as others flee. And here is yet another classic quote from Mr. Buffett on the subject: "If you like to watch football, you probably enjoy the game a little more if you have a bet on it. I like to watch the Weather Channel." Gotta love it!

Saturday, July 08, 2006

Blue Gold

Over the past couple of years, sporadic articles have appeared in BusinessWeek and the Wall Street Journal about water. The sector certainly seems to be under the radar and yet water related indices such as the Bloomberg World Water Index of 11 utilities has returned 35% annually since 2003, far outpacing the S&P 500 and even various oil and gas indices.

Over the past couple of years, sporadic articles have appeared in BusinessWeek and the Wall Street Journal about water. The sector certainly seems to be under the radar and yet water related indices such as the Bloomberg World Water Index of 11 utilities has returned 35% annually since 2003, far outpacing the S&P 500 and even various oil and gas indices. A little bit of digging unearths a plethora of information about gloomy forecasts of a water shortage over the next couple of decades as well as neglected water infrastructure in various countries. From the United Nations to the OECD to the Environmental Protection Agency, there is no shortage of opinion on global water issues.

Big money is certainly getting onboard and has been gearing up to take advantage of the opportunities. The Gabelli Fund recently organized its first Water Infrastructure Conference and is one of the largest shareholders of Watts Water Technologies (NYSE: WTS). Then there is General Electric (NYSE: GE) which has water purification and treatment businesses and expects the opportunity to grow significantly going forward.

We have had the water sector on our radar for some time. Various stocks have pulled back from recent highs and appear to be trading at reasonable valuations. ITT Industries (NYSE: ITT) and Pentair (NYSE: PNR) are a couple of examples. There is also the PowerShares Water Resources ETF (AMEX: PHO) if you don’t want to pick and choose.

We finally pulled the trigger on a mini-conglomerate which recently decided to spin off it water infrastructure business through an IPO. Walter Industries (NYSE: WLT) which has also been the target of various activist hedge funds has been on a wild ride recently.

We first took a position at around $65 and then again at $44 during the recent market decline. The remaining shares of Mueller Water Products (NYSE: MWA) should be distributed to Walter shareholders in short order. Walter currently owns about 75% of the Mueller. A bunch of Wall Street firms initiated coverage of Mueller couple of days ago. Let’s take $20 as a price target. At that price, Walter’s stake in Mueller accounts for $38 of its stock price which is trading at about $55. In other words, you are getting Walter’s natural resources (coal and gas), homebuilding and financing businesses for about $17 a share. Let’s say the homebuilding and financing businesses are worth about a couple of dollars. This leaves $15 for the natural resource business. Assuming a coal segment comparable P/E of 14, this part of the business would only have to earn $0.93 to justify this price. This is way too conservative even if coal and gas prices decline significantly. Plus, the company has locked in the price for its coal through next year at above $100 per metric ton. And I expect demand for Walter’s high quality metallurgical coal used by the steel industry to be sustained for some time.

I think Walter Industries is worth at least $75. So get in on the Blue Gold rush by buying Walter shares and waiting for the full spin-off of Mueller.