Canadians love their Tim Horton’s coffee. Canada’s version of Starbucks Coffee (NASDAQ: SBUX), affectionately referred to as Timmy’s, has been an enormous success since its first store opened in 1964. In 1995, Wendy’s International Inc (NYSE: WEN). merged with Tim Horton’s and facilitated its entry into the US market. Over the past 5 years, Timmy’s has carried Wendy’s on its back and has masked the dismal results at the Wendy’s franchise.

Last July, a hedge fund run by Bill Ackman, Pershing Square Capital, demanded that Wendy’s management raise dividends, initiate a more substantial share repurchase program and implement a partial spin-off of Timmy’s. The shares jumped on the news from around $45 to just above $50 and then retrenched before resuming their upward trend. Ackman has been successful in his recent bid to shake things up at MacDonald’s.

In December of 2005, another well-known hedge fund manager, Nelson Peltz, entered into the picture and made more demands. Most significantly, Peltz asked management to implement a complete spin-off of Timmy’s, sell ancillary businesses improve Wendy’s abysmal operating margins by bringing then on par with industry peers. Previously, he successfully turned around Arby’s and Snapple.

In their regulatory filings, Peltz and his Trian partnership disclosed a 5.5% stake in Wendy’s shares at prices ranging from $48 to $51. After that filing, Wendy’s shares jumped to $55. Trian’s filings lay out the recipe for unlocking value for Wendy’s shareholders. The 13D filing is available on SEC’s web site and makes for educational reading. Trian pegs Timmy’s worth at $32 to $36 a share. These numbers were floating around in a few articles on the internet earlier in the year. Trian’s main thesis is that operating margin at Wendy’s franchise can be almost doubled implying a share value of at least $45 for a total valuation of $77 or higher.

I did not catch wind of all this until middle of January. At $45, Wendy’s shares were a huge bargain. If you believed the rumors that Timmy’s would float at $36, Wendy’s franchise was available at $9 a share! While Wendy’s restaurants’ results have not been spectacular, there is no reason to believe that a competent management team could not turn things around. In any case, perhaps hindsight is 20/20. The question we should ask now is if the shares are worth a look at current prices, hovering around $57?

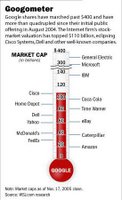

Rumors are that Timmy’s shares will be in high demand. The IPO share price may be as high as $38. The recent success of MacDonald’s (NYSE: MCD) Chipotle Mexcan Grill (NYSE: CMG) spin-off highlights the market’s appetite for this sector right now. Plus, without getting into much detail (I will let you read Timmy’s S1 on your own spare time), Tim Horton’s is a solid growth story. If the shares float at $38, Wendy’s implied valuation per share is about $19. This means there is plenty of value left in the shares if you believe Trian’s pitch and management’s ability to institute a turnaround. Moreover, by buying Wendy’s shares today, you will “lock in” any potential appreciation in Timmy’s shares after the IPO.

Peltz may not get all his wishes. Today, Wendy’s management announced that Timmy’s shares will be fully distributed in 9 to 18 months after the IPO citing tax efficiency reasons. Peltz had hoped for a speedier distribution. On the other hand, Wendy’s management laid out numerous other initiatives to improve efficiencies, sales and margins. While they did not acknowledge Peltz, it seems to me they are on the right track and have effectively endorsed Peltz’s recipe for a turnaround. It will be interesting to see how Peltz reacts to these initiatives.

In my opinion, Wendy’s shares offer a compelling valuation at these levels. While some of the margin of safety may have been eroded over the past 6 months, I believe the prospect of a well received Tim Horton’s IPO warrants taking a position in Wendy’s shares today. Wendy’s franchise will not be fixed overnight, but there is no reason why the operational efficiencies cannot be brought inline with industry peers over the next two to three years. We have taken a position just above $57. May Tim Horton, the National Hockey League legend, work his magic once again.