I opened my first brokerage account at Charles Schwab while I was attending MIT in 1995. I will never forget walking into a Schwab branch and seeing two young kids, supposedly there to greet potential customers, glued to their monitors trading options on tech stocks. It was the beginning of a euphoric period that did not end well. I have to confess that I was caught in the ‘irrational exuberance’ of the moment also. An investment club I co-founded in 1996 had a return of 6 times invested capital before giving up all the gains and more once the technology bubble burst. Needless to say times have changed. So have my investment discipline and philosophy.

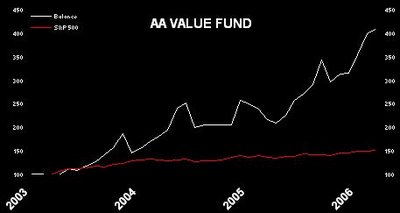

To give you an idea of typical past and current holdings in my value fund since inception, here is a list in no particular order: American Real Estate Partners (NYSE: ACP), Sears Holdings (Nasdaq: SHLD), Petrobras (NYSE: PBR), Smith International (NYSE: SII), Morningstar (Nasdaq: MORN), NYSE Group (NYSE: NYX), Pier 1 (NYSE: PIR), Intel (Nasdaq: INTC), Cisco (Nasdaq: CSCO) and Amazon (Nasdaq: AMZN). Here is what the journey has been like so far.

1 comment:

nice chart chief :)

Post a Comment