“The call is much harder from here, with only scattered Stone Age tribes in the Amazon, the comatose, or newly arrived aliens from Alpha Centauri, unaware that energy stocks are a one way ticket to outperformancedue to demand from China and India, the location of reserves in unstable areas, thelack of investment in new refining capacity, the rate of depletion, the dwindling ability to locate giant new fields, and so on.”

Bill Miller on Value Trust’s lack of exposure to energy stocks, July 2006

Bill Miller is well known for his outstanding record of beating the S&P 500 for 15 years in a row. He manages the Legg Mason Value Trust and is considered a value investor, although you may not agree with that designation given 20% of his portfolio is invested in internet companies including Yahoo (Nasdaq: YHOO), eBay (Nasdaq: EBAY), Amazon (Nasdaq: AMZN) and Google (Nasdaq: GOOG). He thinks the first three are trading at 50% of fair value – my brother and I agree and have added to our eBay position and considering adding to our Amazon holdings.

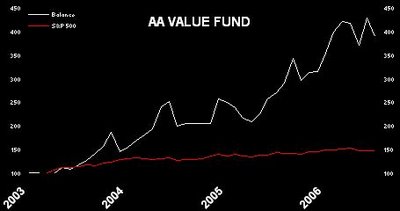

The press is having a ball these days speculating if the run is finally coming to an end as Miller’s portfolio has been decimated so far this year. Miller has admitted as much and in July wrote a letter to his investors reminding them to think long-term and that his portfolio looks different from the index, and may therefore underperform significantly at times, for a good reason: to beat the index you have to look different from the index. In his letter he admitted he was too early to get into homebuilder stocks such as Centex (NYSE: CTX) and Pulte (NYSE: PHM) and that he missed out on energy stocks. Another possible reason to speculate an end to his spectacular run may be that his fund has gotten too big. After all, Buffett has said that “a fat wallet is the enemy of superior investment results.”

In any case, it seems Miller is not alone. Other value managers are singing the same tune. In late June, Bill Nygren of the Oakmark Fund gave a speech at a Morningstar Conference in which he laments the short-term focus of financial media, echoed by Miller in his letter noting the “market’s myopic, obsessive focus on what is going on for the next three to six months.” Oakmark’s recent absolute returns have been nothing to balk at, but Nygren has been underperforming the market. One culprit has been his lack of exposure to energy stocks. The other is his decision to begin buying what he classifies as superior businesses at reasonable prices beginning in 2003.

He provided some interesting data in his slides and focused on 10 stocks Oakmark finds interesting. Stocks we have talked about and included on the list are Wal-Mart (NYSE: WMT), Citigroup (NYSE: C), Home Depot (NYSE: HD), and Tyco (NYSE: TYC). Consider this. These ten stocks have declined 42% vs. S&P 500’s 19% decline from its peak in 2000. Meanwhile, S&P earnings have increased 67% since 1999 vs. 161% for the ten companies. Moreover, on a P/E basis, they are trading at about par with the market. In other words, they are priced as if they are average businesses. If the market is right, well, then they are priced accordingly and Nygren views this as his margin of safety. Otherwise, higher earnings growth and a P/E expansion should reward him (and us) handsomely.

Nygren for one was vindicated after the bubble burst in 2000 as investors who had bailed on him to buy tech-havy funds wished they had stuck with him. Perhaps most importantly, both Miller and Nygren have skin in the game and are invested in their funds. During his speech, Nygren reminds us that it is practically impossible to avoid mistakes when investing. The secret to success is to consistently apply your investment philosophy and discipline over the long run and to stay patient.