"In the short run, the market is a voting machine but in the long run, it is a weighing machine".

Benjamin Graham, The intelligent Investor

A recent study by the CFA Centre for Financial Market Integrity and the Business Roundtable Institute for Corporate Ethics recommended companies stop giving quarterly guidance to encourage long-term thinking among managers, analysts to stop demanding short-term results and for asset managers to have their own wealth tied up in funds they manage.

It’s about time people start to pay attention. Indeed, a few companies are starting to back away from providing guidance. All this mumbo jumbo about missing analyst consensus by a penny or not meeting the whisper number is ludicrous. Meanwhile, ‘investors’ have punished shares of 3M (NYSE: MMM) and United Parcel Service (NYSE: UPS) in recent weeks even though the long-term prospects for those businesses are more than just average.

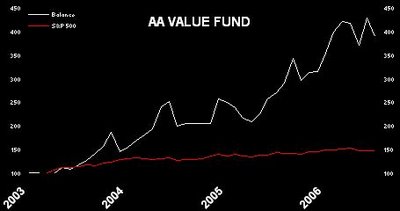

For long-tem investors, this behavior simply creates opportunity. The key is to be patient and have the discipline to believe in your investment thesis and not be swayed by short-term fluctuations in prices. Speaking of fluctuations, the market has provided a fun ride since March. After reaching its highest level in years in May, the S&P 500 fell by more than 7% at some point in June before recovering some of the lost ground and has been practically flat on a monthly basis from May to July. Our ‘value fund’ was also whipsawed during this period but recovered sharply in June thanks to a spectacular run in the shares of the NYSE Group (NYSE: NYX) which seem to have been battered for no apparent reason.

We are weighted heavily in these shares and still believe the shares are undervalued at these prices. Meanwhile, Atticus Capital LP, disclosed on Friday that it has almost doubled its holding in the NYSE Group and now owns just over 7% of the company with options to buy more shares. The firm also has stakes in Deutsche Boerse and Euronext, which has agreed to a $10 billion merger with NYSE. The deal is not done by any means as Deutsche Boerse remains a dark horse and could still derail the agreement. Stay tuned.

We are weighted heavily in these shares and still believe the shares are undervalued at these prices. Meanwhile, Atticus Capital LP, disclosed on Friday that it has almost doubled its holding in the NYSE Group and now owns just over 7% of the company with options to buy more shares. The firm also has stakes in Deutsche Boerse and Euronext, which has agreed to a $10 billion merger with NYSE. The deal is not done by any means as Deutsche Boerse remains a dark horse and could still derail the agreement. Stay tuned.

No comments:

Post a Comment